Energy Flexibility “DIY” technology as important for today as “WFH”

Kiwi Power’s mission to simplify distributed energy is represented in how easy it is for our customers to set up our award-winning Kiwi Fruit hardware and connect to our Kiwi Core software platform.

Learn how the Kiwi Fruit can be easily remotely configured, as well as what types of features to look out for in any “DIY” product, in this LinkedIn article by Kiwi Power’s CEO Jay Zoellner.

Kiwi Power CEO Jay Zoellner explores the need for robust cybersecurity protocols to meet future energy needs in the wake of the Colonial Pipeline attack in this POWER magazine contributed article.

Learn how we can best secure our energy infrastructure as we pivot towards a decentralized energy future here.

.

To unlock the many benefits of energy flexibility across Europe, every local grid operator, or distribution system operator (DSO), if you prefer) will eventually need an easy-to-use, energy flexibility platform to create a virtual power plant (VPP). A VPP is a multi-asset ecosystem that consists of a mix of energy generators, energy storage and energy assets that can be instructed to reduce their consumption, and there are a few key features which are needed to ensure success.

A VPP allows local grid operators to utilise energy flexibility to ensure a more stable energy supply, better energy efficiency and more opportunities for renewables to be accommodated on the grid.

Choosing a feature-rich VPP platform will allow grid operators to innovate at their own pace with limited exposure to risk while staying ahead in a challenging market. But what are the most important features to consider? Here, we summarise the top three features European grid operators should consider when choosing a VPP platform for their smart grid operations.

For more, download our whitepaper which outlines the business case for a streamlined, inter-operable future for local grid operators, where end users make better choices on asset utilisation and utilities make informed decisions based on their operating requirements.

- Collaboration

In order to deliver the European Union’s vision for an integrated energy market, flexibility solutions that have the ability to transcend traditional energy borders will be vital. As renewable penetration increases, European grid operators will need to collaborate closely to ensure the active participation of consumers regardless of geography. Ultimately, this task will be much easier if stakeholders can come together to create a standardised route to achieve their flexibility goals.

As an example, the collaboration between Western Power Distribution and Kiwi Power created a first-of-its-kind template for how local grid operators can come together to simplify participation for flexibility providers across networks through a unified platform.

A VPP platform that can cater to a multi-DSO approach allows local grid operators to share their findings and experiences to hone their offer. The approach also allows grid operators to share ongoing platform costs, which would improve the value proposition while also delivering innovations and improvements more quickly. For example, with the right incentives in place, grid operators can motivate participation, so the more participatory data and feedback they have to understand what works, the quicker energy flexibility can be increased.

- Cloud technology

Cloud technology will be a key enabler for creating energy flexibility. A high level of digitalisation, automation and real-time control will be needed by grid operators to operate in increasingly dynamic markets. And having timely access to data will be more more important than ever.

Kiwi Power’s cloud-based VPP platform provides real-time visibility with ease and gives local grid operators the actionable insights they need to best utilise their assets. What’s more, cloud hosting provides a secure way for grid operators and flexible distributed energy asset owners to interact through the platform, instilling owners with confidence to entrust the operation of their valuable assets to the platform.

- Customer experience

The success of any flexibility market ultimately depends on the participation of energy flexibility providers. If the approach adopted is not an integrated one, flexible distributed energy asset owners with operations across Europe face the prospect of interacting with several local grid operators to engage in flexibility markets.

A multi-DSO approach, such as the one developed by Kiwi Power and Western Power Distribution, allows operators to streamline the process, making participation simpler, easier and less resource-intensive – improving the experience overall. By creating a central platform, flexible distributed energy asset owners will be able to view flexibility locations, requirement data, procurement notices and documentation published by all participating local grid operators in one place.

This will smooth the path for flexibility providers to increase their participation across different areas of operation without increasing the burden to do so. End users will benefit from a standardisation of processes, contracts and more, while being able to manage and analyse participation centrally.

To find out more, choose your Kiwi Experience here or download our whitepaper.

In Fall 2020, four of the six UK DNOs announced they would enable flexibility providers across their networks to participate with one unifying platform called “Flexible Power”. Author Jan Ydens, Head of Product at Kiwi Power, describes the benefits of this unique collaboration and takeaways for flexibility market operators globally.

Read this article at Energy Central

The recent energy crisis in Texas demonstrates that climate change-related weather events are becoming more vicious, and that we need an energy grid that is flexible enough to adapt to such events. To prevent similar crises in the future ERCOT and the rest of the country’s power grid needs a renewed focus. Author Jay Zoellner, CEO of Kiwi Power, describes requirements for achieving next-generation flexibility, and explains why the early days of the Biden administration may be an important window of opportunity to make much-needed progress.

Read this article at Energy Central

What makes Kiwi Power an Energy Technology company?

In over 10 years of operation, Kiwi Power has delivered sustainability impact as a Demand-Side Response aggregator, as an energy storage developer and as a software provider. With the recent emergence of Energy Technology (or even ‘enertech’) as a buzzword, now is the time to explain why Kiwi is – and has always been – an Energy Technology company.

Just what is Energy Technology anyway?

Taken in the broadest sense, ‘Energy Technology’ could refer to a wide variety of disciplines, many of which look like traditional heavy engineering. The global energy system depends on sciences such as chemistry, geology, physics and meteorology. All of these have their own applied disciplines, such as combustion (for thermal power plants), mining (for fossil fuels), aerodynamics (for turbine blades) and weather forecasting (for wind and solar plants). As there is a good argument for describing technology as what you get when you apply science to a practical problem, these must all be energy technologies.

However, just as ‘fintech’ has come to mean the application of computer science to the finance sector, we use enertech to specifically describe the application of computer science to the energy sector.

Energy Technology, or enertech, is the application of computer science to the energy sector.

Advanced software and hardware platform

With this definition in mind, Kiwi is without doubt an energy technology company: we provide a software and hardware platform to meet our clients’ sustainable energy needs. Kiwi has always sought to apply the benefits of computing to the challenge of managing distributed energy resources, even before enertech was a ‘thing’. Over the years, we’ve developed some technology which we think sets us apart, even in this modern and fast-moving field. We describe this as Advanced Energy Technology.

So, what is it that lets us make that claim? To be ‘advanced’, something has to be noticeably ahead in development or capability. Kiwi is continuously developing its platform, so there are always new innovations to consider. However, even looking only at established capabilities, we believe that we have three main areas where we are ahead of the field:

• Secure, low-cost hardware

• Real-time visibility

• Analytical support

Let’s look at each of those in turn.

Secure, low-cost hardware

Kiwi’s Fruit device leverages cutting edge Internet-of-Things technology to provide our clients with a remote metering and control solution which is significantly lower cost than existing alternatives. It does this while achieving high levels of security, an important factor in persuading distributed energy resource owners to entrust the operation of their valuable assets to our platform.

Real-time visibility

Getting hold of useful energy data is such a significant challenge that some other energy technology solutions are happy to show users data that is over a minute old. With the move to increasingly dynamic energy markets, timeliness is more important than ever. Thanks to detailed attention to every stage of the signal chain, Kiwi is able to provide second-by-second data to all users of the platform, and to meet the sub-second response requirements of all major global flexibility programmes.

Analytical support

Rapid acquisition and processing of data is important for real-time decisions, but there is also huge value in being able to analyse events after the fact. When dealing with messy real-world data, it is important to keep track of revisions and re-statements such as the way in which a price forecast changes over time. To be able to analyse such situations, we need to know not only the latest data for each variable, but when we became aware of the data and the period for which it is valid. In fact, we need to track this meta-data for all previous values as well. Kiwi’s data warehouse does this, across the huge volume of incoming real-time data, and in a way that still allows high-performance queries.

What does this mean for me?

For electricity suppliers, distributed energy resource owners, grid operators and aggregators, this Advanced Energy Technology unlocks extra value from their distributed energy resources. Low-cost hardware lets you sign up a greater share of your customers to services which reduce the cost and carbon intensity of their power. Real-time visibility gives you confidence that assets are behaving as expected, and advanced analytical support unlocks actionable insights into how best to monetise your assets.

Do you need Advanced Energy Technology in your business? Take a look at our products for more information or contact us for further details.

To put it simply, there is a daunting array of markets and services open to battery storage and DSR assets in the UK to help generate revenue. From the wholesale market – including the balancing mechanism – to frequency response and other ancillary services, it can be quite overwhelming trying to figure out how best to make assets pay.

No asset owner wants to leave money on the table, so revenue stacking has become an increasingly popular way to raise the rate of return – music to any investor’s ears. But what if there was a way to take this one step further? Enter co-optimisation.

What is co-optimisation?

Co-optimisation takes a short-term view of the market – a month ahead at most – to decide which markets could perform best for that asset, whether the wholesale market or ancillary services. In essence this means having the asset in the right market at the right time. Rather than locking your asset into one market area, you keep a blend of markets open and available.

Sometimes it will make sense to place an asset in a market that is a month ahead to lock in revenue, other times it may be more prudent to wait, expecting far greater returns in closer to real-time markets.

The fundamental truth, though, is that frequency response all day every day won’t give you the best return for your asset over the long-term.

That is what co-optimisation is for: using forecasts, market value and other insights the decisions are made about which market to operate in and when.

How does co-optimisation work in practice?

There are multiple different markets with different bid-in windows – from Short Term Operating Reserve, contracted quarterly, to Dynamic Low High, which is weekly, down to the balancing mechanism, which is closer to real time. Ensuring these markets are accessed and valued correctly gives baselines of value which can then be compared to trading in the wholesale market. Then remains the question of finding markets that offer the right risk and reward profile.

Co-optimisation works best when you have access to a broad range of markets and know them inside out. Patterns and trends start to emerge, so it might be that frequency response is where you make most value for most of the night, but with eyes open to switching markets if other opportunities become more lucrative.

Taking this potential usage profile thinking further we can consider the role of Electricity Forward Agreements (EFA). Through EFAs, the day is broken down into four-hour blocks. These six blocks form the basis of our thinking for where the asset is best placed, but as electricity markets are settled in 30-minute windows, we’re always open to switching assets around in those windows.

Apply that structure across all the different markets an asset may participate in and over the course of 48 half hour settlement periods you have up to 17,500 distinct decisions to make a year.

That’s 17,500 decisions focused on ensuring the asset operates in the most valuable market at any given time. Sprinkle in a degree of price volatility, and these decisions can be the difference between tens of thousands of pounds over the year.

Why do co-optimisation?

As with many decisions, it comes down to the money.

Using the co-optimisation methods we have developed at Kiwi Power, we’d expect to make around 40% more revenue from an asset than just offering firm frequency response (FFR) alone. One of the greatest barriers to storage uptake remains cost, and even marginal gains can make a big difference to investment decisions – and a 40% gain is more than marginal. Co-optimisation transforms the long-term value proposition of a battery storage asset through short-term thinking.

The short-term focus required by co-optimisation means you’re also well placed to capitalise on market moves. For example, when National Grid introduced Optional Downward Flexibility Management in May 2020, assets we managed had the flexibility to capitalise on this market immediately.

Over the past few years, we’ve seen the renewable capacity on the grid grow rapidly, leading to the rise in flexible assets, and now the energy storage boom is set to take off. As competition grows, an effective DSR and battery management strategy will be key to ensure you maximise revenues and don’t restrict yourself to a single market where competition sees the price pressured. By engaging in co-optimisation, battery storage and DSR owners will position themselves to be in the right market at the right time as the grid continues to change and different flexibility services are needed.

Contact our team to find out more: info@kiwipowered.com.

UK wind generation set a new record over the weekend, hitting 16GW during the early evening of Sunday 8th December. The abundance of renewable energy saw imbalance prices tip into negative territory for the longest period in UK electricity market history, from 0:00 to 13:00, with prices falling as low as -£88/MWh. The case for smart, flexible solutions has never been stronger.

We need more energy storage

The market has long believed building interconnectors alongside renewable generation will lead to the Continental market as a whole balancing itself appropriately with clean energy. But high winds across North West Europe highlighted the urgent need for more energy storage capacity so that we can capture clean, cheap renewable generation when it is plentiful rather than letting it go to waste. This will allow us to store clean energy when prices are low and use this energy when the market is constrained and prices higher.

We saw the flip side of renewable generation on Monday 9th December with prices spiking above £100/MWh between 4.30pm-6.00pm as CCGTs came on to meet demand and compensate for falling wind generation.

Monday also saw negative pricing on the Day-Ahead auction for the first time. This volatility was the first opportunity in the UK for an energy storage asset to charge for free or get paid to charge and then monetise a £80-90/MWh spread against prices later in the Day-ahead auction. This relatively risk-free strategy shows investors merchant revenues are there with a partner who manages revenue opportunities against asset cycle costs – typically in the region of £30-40/MWh.

The last 48 hours have been the perfect example of how energy storage can balance the grid in a high renewable system. Energy storage has to be built out so consumers are not penalised by high prices when there was an excess of clean, cheap energy only a few hours earlier. The ability to take advantage of these kind of price arbitrage opportunities – which are expected to become more frequent as our energy mix continues to change – and manage merchant risk is key to bringing forward more investment in energy storage projects.

Battery storage costs continue to fall

Recent analysis by Imperial College London suggests Britain needs at least 30GW of energy storage to meet its 2050 net zero climate goals, up from 3GW today. RenewableUK research puts the current pipeline at 10.5GW.

The good news is prices continue to fall. Lazard’s 2019 Levelised Cost of Storage Analysis puts bids from battery suppliers at record lows of $280/kW, particularly for the largest front-of-meter projects. This should support the continued expansion of investor interest we have witnessed in recent years, backed by sharpening price signals in wholesale and imbalance markets.

Kiwi Power’s distributed energy platform enables energy storage investors to respond to these changing opportunities, simplifying their participation and maximising asset value for global sustainability impact. Get in touch to find out how we can help your business optimise energy storage for long-term, sustainable value.

Any questions? Get in touch.

John Goodenough has long been recognised as the perennial nearly-man of the Nobel Prize for Chemistry. The announcement of this year’s prize—for the development of lithium-ion batteries—therefore came as a welcome shock for many; not least of all Goodenough and his co-laureates Stanley Whittingham and Akira Yoshino.

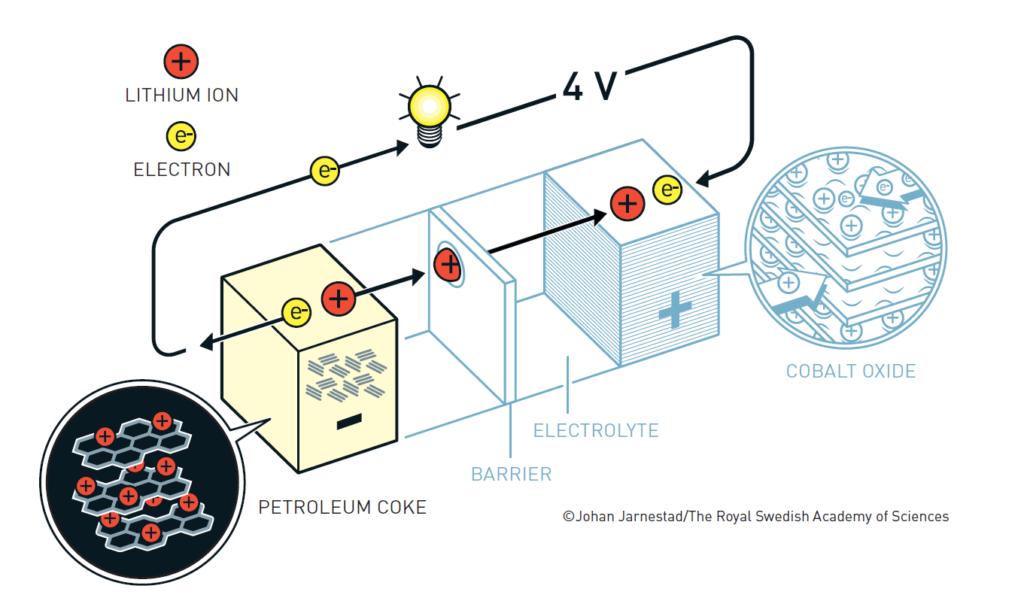

After Whittingham’s initial demonstration of a rechargeable battery based on lithium-ion intercalation into a titanium disulfide cathode with a metallic lithium anode, Goodenough improved the cathode to cobalt oxide. The final step in creating consumer-ready batteries came in Yoshino’s replacement of the metallic lithium anode with one based on petroleum coke.

An electric revolution

These energy-dense rechargeable batteries have revolutionised personal electronics, and transformed modern life around now-ubiquitous portable devices.

Their ability to provide a repeatable, rapid response means batteries are now laying the foundations for renewable energy systems globally – providing vital resiliency and flexibility to enable wind and solar power to be integrated at scale. Simultaneously, through the electrification of transport, they offer the potential to finally wean humankind off its addiction to oil.

batteries are…laying the foundations for renewable energy systems globally – providing vital resiliency and flexibility to enable wind and solar power to be integrated at scale

Battery optimisation

Kiwi Power was charged with optimising the UK’s first grid-scale battery at Leighton Buzzard in 2014, and we now manage a 60MW portfolio of lithium-ion batteries on behalf of our clients. In that time batteries have come to almost completely dominate UK frequency response markets, where a combination of speed and controllability make them an ideal asset.

The August blackout highlighted the importance of ultra-fast response to renewable electricity systems. The synthetic inertia batteries provide can slow the Rate of Change of Frequency and help to avoid generation disconnections which otherwise exacerbate the problem.

Of course, there’s more to managing batteries than simply charging and discharging in response to different grid or price signals. Batteries are built to deliver a certain number of cycles and there is a cost-benefit to every action. Maximising value requires a detailed understanding of a system’s characteristics and means constantly evaluating the revenue opportunity against its impact on lifespan.

Benefit for humankind

Analysis suggests that meeting the UK’s 2050 carbon targets will require more than 100GW of new wind and solar generation over the next 30 years, balanced by 30GW of short duration storage, so for those that can compete and deliver the best outcomes, there is a huge market opportunity.

It goes without saying that Kiwi Power were delighted to hear of the recognition of the laureates behind this transformational technology. In his will, Nobel famously created the prizes to be awarded to those who confer “the greatest benefit on mankind.” It is hard to think of three more deserving recipients.

Keep up with global energy industry trends and Kiwi Power’s developments in our Resource Centre.

As battery owners and operators seek to maximise the returns from their assets, they simultaneously face the Herculean challenge of managing degradation. This remains one of the most prominent challenges in the industry, where assets are expected to last around 15 years before reaching End-of-Life (EoL).

Degradation manifests itself in several ways leading to reduced energy capacity, power, efficiency and ultimately return on investment.

Put simply, battery degradation is a serious economic problem which will vary according to how the battery is used. It is therefore essential to monitor factors which drive degradation. These include temperature, ramp rate, average State of Charge (SoC) and Depth of Discharge (DoD).

Analysing the impact of these factors is vital to assessing the cost-benefit of decisions to charge or discharge a battery in response to different market signals.

This is especially important as single/multi-service batteries have the option of participating in a variety of markets, such as frequency regulation or the Balancing Mechanism (BM), and each market can have a different risk level according to the asset’s load profile and cycling behaviour.

Back to basics: what ‘exactly’ is a charge cycle?

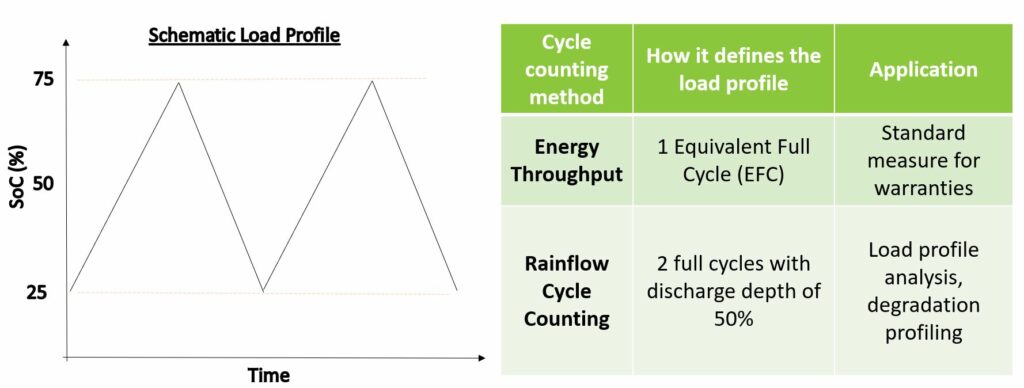

Unfortunately, and confusingly, the industry has different definitions for what ‘a cycle’ actually is. In commercial documents, such as warranties, a cycle is calculated via energy throughput. This tallies the energy going in/out of the battery and divides total energy throughput by capacity. Even though this is a relatively simple calculation, it actually only tells you the number of ‘Equivalent Full Cycles’, or EFCs.

EFCs do not quantify DoD, which factors how deep charge cycles are. As can be seen below, EFCs would be unable to distinguish 1 cycle of 100% DoD vs 2 cycles of 50% DoD vs 10 cycles of 10% DoD. Cycle depth is completely ignored in EFCs! For this reason, Kiwi Power utilises the Rainflow algorithm as a tool for profiling each ‘real cycle’ in terms of DoD.

DoD is one of the biggest contributors to battery degradation. As an example, a Lithium-ion battery has ten times more degradation when operated at near 100% cycle DoD compared to when operated at 10% DoD for the same amount of charged power. It’s likely in the future that DoD measurements will be included in warranties. This will be especially the case as batteries move from frequency regulation, which has shallow cycles, to other programmes such as trading in the BM which requires deeper cycles.

The Rainflow tool and how it can be used for battery profiling

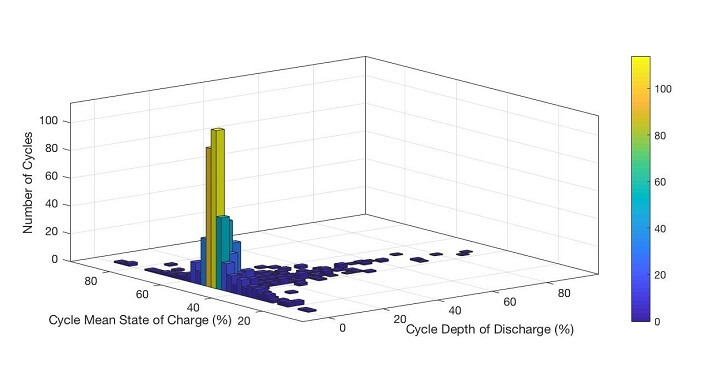

The Rainflow cycle counting tool is an algorithm used for DoD calculation. It takes irregular load profiles and quantifies every cycle’s DoD, mean SoC and time period. This helps to paint a picture of how the battery is behaving and enables the operator to make informed decisions.

As you can see below, a typical load profile can be very noisy and cycle counting manually is near impossible. The Rainflow histogram makes sense of the data by categorising the cycles according to their DoD and mean SoC.

More importantly, the tool tackles the battery degradation problem by identifying cycles with a high DoD or with cycles that are outside an acceptable SoC range.

Energy trading in the UK’s Balancing Mechanism (BM) market

Energy trading will require deeper cycling. Kiwi Power’s analysis suggests DoD is typically 20-30% higher for assets in the BM compared to firm frequency response (FFR). Average SoC on the other hand, will vary enormously depending on the price points set in the BM model. Without a SoC management plan in place, active pricing strategies will result in an asset having a very low average SoC (often <20%) while passive pricing strategies will result in an asset having a high average SoC (often >80%).

As battery business cases increasingly rely on wholesale and BM participation, these figures demonstrate the need to select a battery management system that captures these insights to mitigate degradation risk and optimise revenue.

Kiwi Power’s expert team use our intelligent technology, deep market insight and unparalleled asset knowledge to do just this. Since connecting the UK’s first grid-scale battery at Leighton Buzzard in 2014 our portfolio has grown to over 50MW of behind-the-meter and grid-scale energy storage systems which we monetise on behalf of asset owners and investors. Our novel approach to measuring battery load profiles and analysing charge cycles is one way we’re able to ensure our client’s assets deliver maximum value and life expectancy.

Any questions? Get in touch.