Kiwi Core: enabling everybody to play a role in a sustainable future

There are many definitions of sustainability out there, and they have slightly different nuances. At Kiwi Power, we like the definition in the charter for the UCLA Sustainability Committee, where sustainability is “the integration of environmental health, social equity and economic vitality in order to create thriving, healthy, diverse and resilient communities for this generation and generations to come. The practice of sustainability recognizes how these issues are interconnected and requires a systems approach and an acknowledgement of complexity.”

Sustainable practices support ecological, human, and economic health and vitality. Sustainability presumes that resources are finite, and should be used conservatively and wisely with a view to long-term priorities and consequences of the ways in which resources are used.”

Everybody knows that wholesale deep decarbonisation is needed for us to be able to sustain future generations. Achieving net zero carbon emissions has become a common aim for countries and businesses around the world as we collectively, yet belatedly, attempt to keep the planet we live on under a 1.5 °C rise in global warming since pre-industrial levels.

This warming limit, which according to the Intergovernmental Panel on Climate Change (IPCC) will still result in “high interrelated climate risks”, is, sadly, unlikely to be met due to the slow reaction of national governments and businesses around the world – and in spite of a large community of climate scientists shouting until they are blue in the face for at least the last couple of decades.

However, a combination of innovation, rapid uptake of new technologies and a huge shift in mindset presents hope for a better future. In the context of the energy system, it’s clear we need to transition to the highest amount of renewables (and low-carbon sources of energy) as is practically possible – and economically viable – in the quickest time possible, whilst ensuring grid stability.

This presents challenges. As renewables are powered by intermittent sources of energy (the sun and the wind), a huge increase in dispatchable (meaning you can turn them on or off) energy resources (what we at Kiwi Power call flexible energy assets) is needed. In fact, renewables can only achieve sufficient market penetration – lessening the need for power-hungry, centralised, fossil-fuel generated backup – with a fully flexible power system that monetises, rather than punishes, intermittency.

Energy flexibility will be a key concept that everybody – from national governments to corporations to individuals – will need to embrace if we are going to deliver on a truly sustainable energy system. Kiwi Power’s Virtual Power Plant technology, Kiwi Core, exists to provide that flexibility whilst making it as simple as possible to understand and benefit from and as such, plays an integral role in the low carbon transition.

Energy flexibility – the act of modifying the energy output or consumption of one or more flexible energy assets (often known as Distributed Energy Resources) in line with changing demands on/by the grid.

Energy flexibility is also a key cornerstone of a more equitable and fair energy system. By building the simplest, most user-friendly distributed energy platform on the planet, we aim to enable as many power producing and consuming resources as possible to have an active role to play on the grid and a home on the Kiwi Core platform. Instead of simply being energy consumers, the individuals and companies of tomorrow can enjoy the financial benefits that can be realised by monetising the energy they produce, whilst playing a part in the stabilisation of our energy system for generations to come.

As the definition from UCLA above says, the picture is complex and it will be a long time – if ever – before our energy grid doesn’t at least partly rely on large, centralised power plants. In the meantime, energy flexibility allows us to make this transition to more low-carbon electricity without the need to build new, expensive infrastructure; giving governments a different framework in which to design their energy system and businesses and consumers an opportunity to play an active role in revolutionizing the way we produce, consume and think about energy. Get involved.

The UK is already seen as a global leader in energy market innovation, and the speed at which the National Grid Electric System Operator (ESO) is revising its services in response to changing market conditions ensures that it will remain ahead of the game.

Kiwi Power has rapidly responded to the changes proposed, innovating to deliver broad access to ancillary services for our customers. The most recently launched – the fast-acting, post-fault Dynamic Containment service – is the first of many UK Frequency Response products planned in.

Intermittency is increasing in energy supply

As we look back at lessons learned in the energy sector over the past tumultuous year, the one thing we can be certain of is more change. As renewable penetration grows across our power supply, the technological and market-based challenges posed by intermittency also increase. Issues with low voltage, inertia and frequency needed rapid responses from all players in the energy system to keep the lights on, and predictions last year were that it was going to cost the National Grid ESO an estimated £826million in balancing supply (which was in abundance due to increased renewable generation) and demand (which was very suppressed due to the pandemic).

As a response to these challenges and to provide critical support for the UK, National Grid ESO has already launched a number of new services, including Optional Downward Flexibility Management (ODFM), which offers commercial-scale renewables generators remuneration for switching off. It also revised the timings of the Response and Reserve Roadmap, launched in 2019, to speed up plans to implement Dynamic Containment, Dynamic Moderation and Dynamic Regulation, with the three together set to replace firm frequency response (FFR) over the next few years.

The first roll-out: Dynamic Containment

The first frequency response product, Dynamic Containment, was soft beta-launched in September 2020, with the final specs for battery owners requirements evolving since then. A key point of difference between this and the current FFR service is that Dynamic Containment will be procured in 24-hour blocks on a day-ahead basis, compared to the week-ahead and month-ahead procurement of FFR, meaning we are getting closer to real-time procurement of ancillary services (at the moment, it is operating on a week-ahead basis with daily changes, but it will soon change to day-ahead).

Due to this shortened response timeframe, Dynamic Containment is only applicable to fast-response assets such as batteries, interconnectors and flywheels. Currently, battery owners can earn £17 per MW hour (versus £6 – £12MWh for other services) as well as enjoying a slower rate of battery degradation due to less cycling and fewer charging cycles, which in itself can have significant economic implications. The launch of Dynamic Regulation in Feb 2022 – to work on specific requirements for flywheel and interconnector markets – gives a further indication of ancillary services development.

Adapting our Kiwi Fruit hardware to match new services

In response to the new technical requirements needed to participate in Dynamic Containment, and in line with its mission to simplify energy flexibility for as many entities as possible, Kiwi Power has rapidly responded to the beta-launch specs finalised in February 2021 to adapt its hardware, the Kiwi Fruit, to give battery, flywheel and interconnector owners the opportunity to take part. This contrasts with other flexibility providers who have had to develop new hardware and work with customers to replace their current models.

The Kiwi Fruit was designed as a sophisticated yet extremely low-cost piece of equipment that can be quickly programmed to respond to future energy needs without the need for constant upgrades. This new iteration of its programme means that the Kiwi Fruit is already in a good place to support the next round of ancillary services that National Grid ESO plan to launch.

This means that, when Dynamic Containment officially launches later this month, we will have already implemented a solution that any compliant battery owner can use to bid into this very attractive, currently underutilized market. In fact, to encourage asset owners to participate, National Grid ESO has ringfenced some of its bidding capacity for companies like ours who have done full implementation with live monitoring. We recently helped one of our clients bring 22 of their assets onto the Dynamic Containment market. Collectively, they act as one single source of power and generate a healthy amount of profit.

How to participate in the new Dynamic Containment market

For energy managers looking to benefit from the rapidly evolving ancillary services in the UK energy market, Kiwi Power has everything ready to go to enable a quick and simple connection. In terms of applicable assets, you will need:

- An asset capable of at least 1MW of continuous power delivery for 15 minutes*

- An asset that can always provide minimum response in 0.5s and full response in 1.0s**

- An asset that can always deliver an accuracy of ±3% of the contracted value

- Access to GSP HV Metering and Control Breaker Position

- Access to an asset-level metering point for Kiwi’s Metering Segment hardware, that excludes any auxiliary load

- To supply evidence of Grid Code protection settings compliance

- To pass National Grid’s prequalification requirements, assisted by Kiwi

* Energy limited assets participating in Dynamic Containment high+low will need to reserve additional headroom

** Including 3rd-party controller latency

We’re excited by the speed at which the energy market is changing and we want to bring others with us. If you have assets that meet the above criteria, get in touch to find out more about our Kiwi Fruit and its accompanying platform, Kiwi Core – a best-in-class Virtual Power Plant software that brings the power of our rapid innovation to your desktop. We can help you understand the new services that are launching so you are ahead of the game and ready to benefit from the rapidly changing energy landscape we see being shaped today.

By Thomas Jennings, Head of Optimisation

At Kiwi, our customers are often worried that running their generator might have a negative impact on the environment. Our response is always that the reality is a little bit more nuanced than that, and that perhaps we need to reframe the question to: what service does a generator provide right now, and is it better than the alternatives? And how can it help us transition to a more sustainable energy system?

Filling the gaps

When National Grid is asking a generator to provide flexibility it is more often than not because they are lacking generation. This might be because demand is higher than expected, or the level of generation is not as high as anticipated. These fluctuations in demand and supply are increasingly driven by the intermittent and unpredictable nature of renewable energy, from both large in Front of Meter Offshore Wind farms, and smaller Behind the Meter solar roof tops.

To fill the gaps caused by these fluctuations, and facilitate our move to Net Zero, predictable flexible energy assets are needed. Historically, this flexibility has been provided by large centralised generators, such as Coal and Gas power plants. However, there is an increasing role to play for smaller decentralised assets to provide this flexibility.

Decentralised vs centralised: which is more efficient?

Now, at this point another question is thrown at me…

Surely, a large centralised asset is more carbon efficient than a small generator? You can’t be suggesting that decentralised generation will get us to Net Zero faster?

That is exactly what I am suggesting.

The reason behind this is the energy acronym MNZT or Minimum Non Zero Time. Whilst a centralised asset is more efficient on a CO2e per MW basis, this is only true on a MW for MW basis. When you start looking at the total run time for the asset the picture becomes clearer. But before we go into that, let’s muddy the water a bit first with some more acronyms:

|

Acronym |

Term |

Description |

|

MNZT |

Minimum Non Zero Time |

The amount of time a generator must be generating once turned on. |

|

SEL |

Stable Export Limit |

This is the minimum level of generation the asset must achieve to provide a stable load, efficiently operating and start providing flexibility. |

|

MEL |

Maximum Export Limit |

This is the maximum output available, the difference between this and the SEL indicates the plant’s flexibility. |

|

MZT |

Minimum Zero Time |

This is the time a generator must be turned off for, before it can be turned on again. |

When we compare the parameters of a centralised generator to a decentralised one the picture becomes a lot clearer.

To achieve 40MWs of flexibility with a centralised generator that is not currently generating, it needs to be warmed up over three hours in advance to first get to its SEL (in this case 175MWs) and then increase to the additional 40MWs for exporting.

To achieve the same flexibility with a decentralised generator requires considerably less CO2e, despite not being as efficient when running.

Putting it all together

Now consider a scenario where we need to run additional flexibility in the next few hours after this 40MW has been generated. The centralised plant must be off for at least 3 hours (its Minimum Zero Time) before being started again, so it cannot provide flexibility during this time. Often, this means large centralised generators are left on and generating in case additional flexibility is required at short notice.

This in turn means that sources of renewable energy don’t have a chance to be deployed because generation requirements are being met by large centralised assets that are left running – which builds a strong case for the need for small decentralised generators to be providing flexibility, as they can be switched on and off more quickly, allowing more room for renewable generation and thus supporting the move to Net Zero.

The ace up your sleeve

At Kiwi Power we are seeing an increasing interest in Kiwi Core as Energy Managers, and their consultants, look to use our software to provide the necessary flexibility to enable the grid to transition to renewables, whilst generating revenue. Many are seeing Kiwi Core as an ‘ace up their sleeve’ to pull out during difficult conversations.

We’d love to help you transition into making the most of energy flexibility. We invite you to talk to us about what that might look like for you as we quickly shift into this very different, much more sustainable future with energy flexibility at its core.

The transition to fixed charging- and how Kiwi Core can help you ease the pain

I can imagine the conversations that many Energy Managers will have been having with their bosses since the Targeted Charging Review was published at the backend of 2019. ‘Do you want the bad news, or the bad news?’.

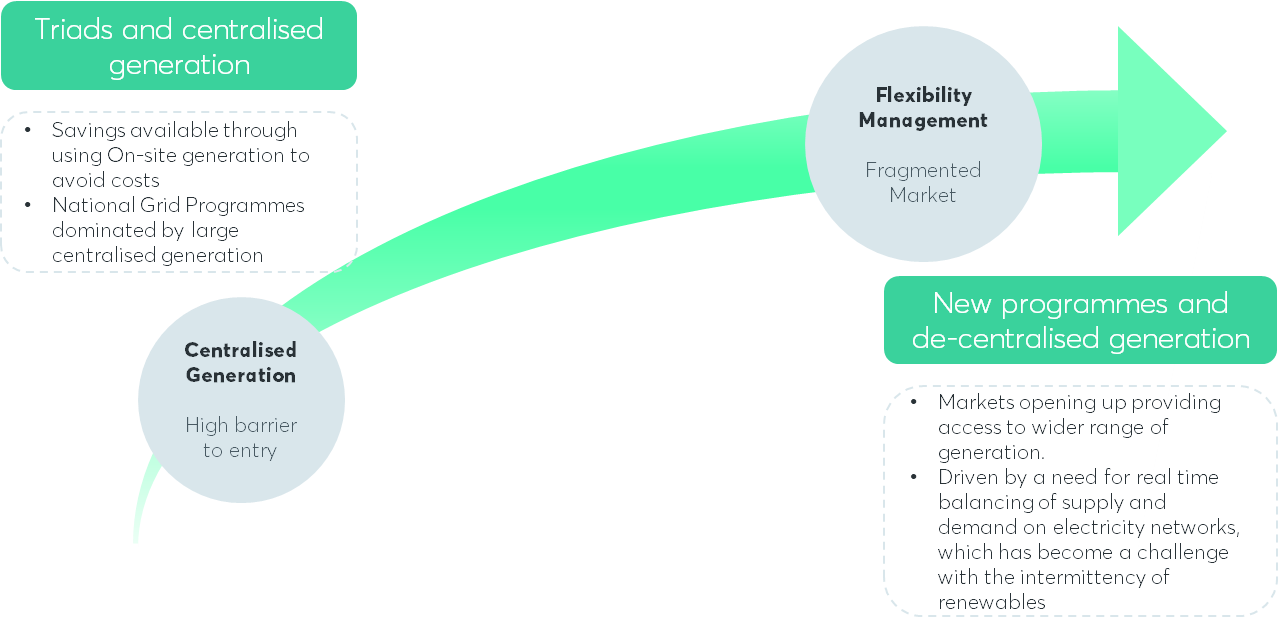

Historically, there has been a big focus for these Energy Managers on cost avoidance – helping some companies save millions of pounds through cleverly managing their operations so that they were running less, or or even zero power during the three Triad1 periods set annually by the National Grid.

But as of April 2022 (after it was delayed a year), this system will change – no longer providing a way for people to avoid charges through behaviours such as load shifting or on-site and embedded generation.

Ofgem’s aim is to create a level playing field between flexible users that are able to reduce consumption during peak periods and those with a lack of flexibility who are currently left paying a higher price. They also propose to remove perceived cross-subsidies from Embedded Benefits to other less flexible customers.

There are many good reasons for doing this – not least because this will create more predictability on the grid as power generation is evened out, helping it to become more stable, efficient and sustainable; at the same time, it’s a very different way of operating which the industry will have to quickly adapt to – and big industrial energy users may rack up millions more in energy bills as a result.

But there is some good news. Whereas it is unlikely to yield the kinds of cash that cost avoidance did, it can go some way to easing the blow.

The asset that you used to avoid a cost is highly likely to be able to be utilised in the flexibility market. By shifting the way we see our onsite energy generation so that it becomes a source of revenue, we can go some way to recouping some of the money that we will have to pay with the new charges by making the most of the Flexible Energy Assets already in our hands.

Our energy flexibility platform, Kiwi Core, helps you generate revenue by giving you access to multiple markets in which to sell the energy that you generate – both on a national scale through the various Ancillary Markets or locally through distribution managed constraint markets. It all sounds very complex, but we make it easy to choose the right option by simplifying participation so anyone can do it, whilst ensuring you’re operating at a level of risk that is comfortable for you and making the most revenue possible.

Of course, demand management won’t disappear. You can still save money by turning off your power; and coupled with the reduction in decentralized generation as coal plants are decommissioned, and the increase in intermittent renewable sources, there is an increased need for real-time balancing of supply and demand on energy networks. We can help you support this move to a renewable network by enabling you to sell power to the markets when it is needed, helping to even out that intermittency.

This transition to renewables saw a huge surge forward last year as a result of COVID-19, giving us a valuable glimpse into a net zero future. In a recent webinar we ran, John Twomey – Head of Market Development at National Grid ESO – shared that he saw energy demand suppressed by up to 20%, plus a really high penetration of energy flexibility. Over a particularly sunny bank holiday weekend, we saw some settlement periods of 100% renewables.

In response, the National Grid had to quickly introduce a new ancillary service in the form of an ODFM (Optional Downward Flexibility Management) product. This is targeted at smaller Flexible Energy Assets, of which 4GB were quickly signed up – providing us with a service where we can turn down generation as and when we need it.

As we continue to move towards Net Zero, and increased renewables penetration, many Energy Managers will be asking how they can help support the transition to a more sustainable future and ensure they are making the most of the opportunities out there. They will also be asking how they can afford the money to pay the new charges.

At Kiwi Power we are seeing an increasing interest in Kiwi Core as Energy Managers, and their consultants, look to use our software to access the flexibility markets, generate revenue to replace the value eroded through the loss of Triads and provide the necessary flexibility to enable the grid to transition to renewables. Many are seeing Kiwi Core as an ‘ace up their sleeve’ to pull out during difficult conversations.

We’d love to help you transition into making the most of energy flexibility. We invite you to talk to us about what that might look like for you as we quickly shift into this very different, much more sustainable future with energy flexibility at its core.

1. Triads are half-hour settlement periods that are used to determine charges for demand customers based on how much power they are using at the three highest peaks of electricity annually. They typically occur between 4pm and 6pm on weekdays between November and February each year and must be at least ten days apart.

“Knowledge of things and knowledge of the words for them grow together. If you do not know the words, you can hardly know the thing.”

― Henry Hazlitt, Thinking as a Science

Words matter. And particularly in a burgeoning industry like the energy flexibility market, they can be slippery – transitioning over time to mean something else, or even spawning other words with related but slightly different meanings. At Kiwi Power, we often see the same word used interchangeably for two different things, or people talking at cross purposes without realising.

One of Kiwi Power’s core values is simplicity. We want to make things as easy to understand as possible – for everyone, new and old to the flexibility industry. We believe that as well as providing a fantastic service, it’s our duty to educate where we can to make energy flexibility as accessible as possible. By lifting the lid on this complex universe of terms, and making them easy to understand, we aim to accelerate the transition to a more sustainable energy system.

We thought it would be helpful to define what we mean when we talk about terms like ‘flexible energy assets’, ‘energy flexibility’ and even DNOs. So, see below for our official ‘Distributed Energy Glossary’, which will grow and change over time. You’ll see that in many cases, we have included more than one word to define a thing. That’s because people across geographies and industries will use different words. You’ll also see what we have coined ‘flexible energy assets’, and that we will in time transition from ‘distributed energy platform’ to using ‘energy flexibility platform’ for Kiwi Core.

Glossary Terms

-

ENERGY FLEXIBILITY PLATFORM

-

Our energy flexibility platform, Kiwi Core, allows everyone from local grid operators to owners of flexible energy assets to enjoy the benefits of energy flexibility. It utilises Virtual Power Plant technology, but goes much further.

For example, it:

- Allows you to register Flexible Energy Assets onto an easy-to-use digital platform that monitors the energy market in real-time, all the time;

- Allows asset owners to reduce their overheads and unlock untapped revenue by participating in the energy flexibility market;

- Monitors the grid and make small adjustments to Flexible Energy Assets by turning them up or down in response to changing energy demands, ensuring a more stable and efficient grid;

- Enables aggregation of smaller Flexible Energy Assets so that they can buy energy from a single developer, or multiple developers, as one larger entity – retaining the economic advantages of a high-volume purchase.

-

FLEXIBLE ENERGY ASSETS

-

Kiwi is transitioning from the use of the term Distributed Energy Resources (DERs) to Flexible Energy Assets.

Flexible Energy Assets are energy resources (potentially geographically distributed) that can be used on their own, or aggregated, to provide energy flexibility at times when the grid needs more or less power. They tend to be small-scale and are typically located within the electric distribution system at or near the end user.

Flexible Energy Assets include controllable loads (meaning that, in the simplest terms, they can be turned off or on, or turned up or down), conventional and renewable generation as well as storage. Common examples include rooftop solar PV units, battery storage, thermal energy storage, electric vehicles and chargers, building management technology, and smart meters.

Flexible Energy Assets are often referred to as “behind the meter”, because the electricity is generated or managed ‘behind’ the electricity meter at your business.

-

VIRTUAL POWER PLANT (VPP)

-

A Virtual Power Plant (VPP) is a shared ecosystem of energy generators, energy storage systems and businesses with turndown assets (such as fridges and heaters) – what many call ‘distributed energy resources and what we at Kiwi Power call ‘Flexible Energy Assets’ – all wirelessly connected, and managed through an energy flexibility platform (such as Kiwi Core).

As well as giving asset owners the opportunity to participate in energy markets, VPPs utilise energy flexibility to ensure a more stable energy supply, better energy efficiency and more opportunities for renewables to be accommodated on the grid. Ultimately, they give businesses the opportunity to make more profit, reduce their overheads and cut their carbon footprint with no disruption to their energy supply or financial risk.

-

DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM (DERMS)

-

DERMS solutions share some common capabilities with platforms like Kiwi Core that enable VPP management – such as Flexible Energy Assets registration, aggregation, forecasting, real-time monitoring and control, optimisation and dispatch.

However, beyond these common capabilities, solutions like Kiwi Core uniquely provide capabilities for market participation (bidding, communication) and economic participation, whereas DERMS solutions are more about the physical operation and optimisation of Flexible Energy Assets – for example:

- Voltage management of the grid

- Optimisation of the power flow within the grid

- Local grid load management (e.g. for smart grid projects)

Kiwi Core works well in conjunction with DERMS systems – for instance, whilst our technology helps you manage a portfolio of Flexible Energy Assets, a DERMS solution will make sure we do that within the bounds of physical constraints.

Companies offering both VPP and DERMS technology almost always have come from one side (VPP or DERMS) where they are strong, and have ‘bolted on’ the other side due to customer/project demands. You end up with a strong VPP and weak DERMS or vice versa. With Kiwi Core, you get a strong VPP and you can license a strong DERMS to go with it if you need that functionality (you often do not). That way, you get the best of both worlds, and Kiwi Core will talk to the DERMS happily.

-

AGGREGATOR / AGGREGATION

-

Please note that this is an important legacy term, but is becoming increasingly a little dated as aggregation becomes less important for flexibility (there is no need to aggregate energy from smaller Flexible Energy Assets because technologies such as Kiwi Core allows them to participate directly in the energy system). It is, still however, a crucial part of the current energy mix, hence including a definition here.

Historically power markets have been designed for large centralised power stations and thus the minimum power (MW) thresholds for market participation have been larger than the typical Flexibility Energy Asset. Aggregation of multiple Flexible Energy Assets was required for market participation. With power markets permitting smaller and smaller assets to participate, aggregation is required less often.

As Kiwi Power was originally an aggregator itself, we know exactly what the challenges are and how to solve them to run the most efficient and profitable VPP possible. Our ten years of global experience in this emerging field has helped us build a best-in-class distributed energy platform, Kiwi Core, which means that aggregators can manage Virtual Power Plants easily and effectively.

We support a wide range of Flexible Energy Assets (both storage, generation and turndown) including those that are large enough to participate on their own without being aggregated. Therefore, aggregation is important – but not essential – for energy flexibility and Kiwi Core’s operations.

-

DEMAND RESPONSE / DEMAND SIDE RESPONSE / ENERGY FLEXIBILITY

-

Demand response, or energy flexibility, is the act of modifying the energy output or consumption of one or more Flexible Energy Assets in line with changing demands on/by the grid.

Historically, electricity grids were managed using “generation response” – meaning that the generation side of the grid was continually varied to meet the demand. When it became possible to also modify demand, the term “Demand Response” arose.

When total demand for electricity is at its highest – like when we’re all glued to the Great British Bake Off final in the UK, or the Superbowl in the US – we can use electricity more intelligently, rather than simply generating more to meet short periods of huge demand. For example, supermarkets might turn down their freezers, or large factories might delay an energy-intensive process to another time, when there’s not so much rush-hour traffic on the energy grid.

Energy flexibility is becoming increasingly critical with the growth of renewables, which fluctuate in terms of the energy they generate. This means that not only is there an intermittent need to produce more power, but also a need to mitigate over-supply by ‘turning down’ Flexible Energy Assets so that the grid remains balanced and efficient. Thus, energy flexibility is crucial in supporting the transition to lower-carbon generation.

Kiwi Core allows owners of Flexible Energy Assets to both supply and turn down energy in a way that does not disrupt their business operations but helps to balance the grid, generate revenue and reduce overheads – all whilst helping our energy system transition to its cleanest, smartest self.

-

LOCAL GRID OPERATORS

-

Depending on the market, Local Grid Operators may also be referred to as DNO or DSO.

Put simply, a grid operator is a company licensed to distribute energy.

Note we’ve used ‘smarter’ grid operators here, not ‘smart’. The idea of a ‘dumb’ grid is now very out of date, given longstanding developments in the field and the exponential growth of new energy flexibility technologies such as Kiwi Core. However, in line with recent UK government policy announcements, we have also included ‘smart systems operators’ as a term that we will continue to use in some cases.

Put simply, a grid or systems operator is a company licensed to distribute electricity.

These companies own and operate the system of cables and towers that bring electricity from the national transmission network to our homes and businesses. But increasingly, they are also a key player in managing and supporting the transition to an energy system that’s fit for the future – which is less about building more physical infrastructure to accommodate growing energy needs, and instead becoming an active manager of the grid by embracing energy flexibility to ensure we can efficiently balance power generation and consumption across the grid.

When we talk about grid operators, names and roles vary by geography. Broadly, these entities used to have a sole focus on building and managing the physical infrastructure that was designed to have electricity flow one way from a large centralised source such as a power station. Now, they are supporting the transition to an energy system where electricity flows both ways and is balanced and synchronized across hundreds, even thousands of power sources at once – what we call Flexible Energy Assets, which can range from large commercially owned developments to smaller scale generators.

In Europe, we can see this transition reflected in the terms ‘DNO’ (Distribution Network Operator) and ‘DSO’ (Distribution System Operator). By embracing energy flexibility and transitioning to DSOs, DNOs can avoid some of the costs associated with network upgrades and enable customers to connect to power quicker and at a lower overall cost. That’s not to mention the sustainability benefits of a more efficient energy grid.

In North America, the role is played by different entities (and not as strictly segregated as it is in Europe). E.g. local utilities may have both typical utility as well as local grid management responsibilities, and are therefore often in a position of acting as DSO and Aggregator at the same time. As a whole, it is true to say that the North American energy market is embracing the flexibility revolution.

-

SMART GRID

-

‘Smart’ is becoming an old-fashioned term; there is no such thing as a ‘dumb’ grid nowadays given technological developments and also mindset shifts in the ways that the energy industry conceptualises and manages its energy system (as something to balance efficiently through energy flexibility, rather than a physical infrastructure that must keep growing).

The grid is certainly getting smarter all the time as energy flexibility becomes the norm, and the entities that manage power are also having to grow their expertise and skills in this area. For a description of how the grid and key stakeholders are evolving, see the explanation above about the translation of DNOs to DSOs.

Supporting technologies, like Kiwi Core, keep getting better and better also, opening up the market to a wider number of organisations who stand to benefit from these developments.

You could also say that ‘smart’ is synonymous with the growth in renewable energy coming online, as more and more sources appear which offer more possibilities for energy flexibility.

By Thomas Jennings, Head of Optimisation, Kiwi Power

Dubbed as the “greenest year on record”, 2020 saw a string of net-zero achievements including instances of 100% renewable settlement periods. The grand finale on Boxing Day saw wind from Storm Bella contribute over half (50.7%) of the UK’s daily electricity.

Though undeniably challenging, 2020 was a real catalyst for flexible distributed energy. With the sudden depression of electricity demand by up to as much as 20% and the continued high penetration of renewables coming onto the grid, 2020 provided a looking glass into what the future holds. As net zero scenarios began to rapidly unfold in real time, the vital role for flexible distributed energy resources in aiding our transition, was firmly cemented.

Inspired by a recent panel discussion I was lucky enough to lead with some key industry figures – including John Twomey – Head of Market Development at National Grid ESO, Madeleine Greenhalgh – Policy & Advocacy Manager at Regen, Steven Meersman – Founder Director at Zenobe and Hugh Brennan – MD at Hive Energy – I’ve distilled what I feel are three key lessons we can all take from 2020.

Lesson 1: Rapid change is possible

National Grid was quick to react, including introducing a new flexibility product in April targeting smaller distributed energy resources to help manage changing system conditions. Implemented in an immensely short period of time, the Optional Downward Flexibility Management service was a ‘learn-as-we-go’ response to the changes that was widely lauded by the market.

With uncertainty being the new normal, there are some important lessons that we can take to build on the initial successes of 2020. For one, the industry is very open to trialling new flexibility services but also wants some assurances in the direction of travel so that investment in flexible distributed energy can be made with confidence. Open dialogue and the flexibility to incorporate feedback will be essential as new products and services come to market.

Lesson 2: Collaborative approach

A lot of the changes we will need to see will depend on regulators and the market coming together in ways that they have not done before to make policy and markets easier to navigate. Constructive dialogue is vital and moving forward this may require new platforms that support discussion and collaborative action. Further, the local aspect of these developments cannot be understated; solutions will need to be tailored by location.

Another element that is gaining greater traction is the shift from achieving a decentralised grid to doing so only with decarbonised flexibility. Much like the incoming switch from 100% renewable energy to 100% renewable energy 24/7/365, now that we have the basics in place, we must begin to take flexibility a step further. In essence, this is about recognising the value of low carbon assets and giving them the same step up in flexibility markets that renewables have enjoyed more broadly.

Lesson 3: Data Transparency

Finally, as in most industries, real-time data is coming into its own. Facilitating transparency, it helps developers and storage businesses optimise their assets by evaluating the costs, risks, and opportunities associated with their market participation. Ultimately, better data improves outcomes and drives down the cost to the consumer. With that in mind, National Grid is increasingly looking to put consistent, machine readable data out into the market with 75% of its capital expenditure for the next two years allocated to IT and data architecture upgrades. But this is not simply a task for the system operators, every market participant has a role to play in information sharing throughout the value chain.

Get in touch with Kiwi Power if you want to find out how your business can benefit from power market shifts.

Gavin Sallery, Chief Technology Officer at Kiwi Power, introduces himself and the story behind Kiwi Core.

Where did you join Kiwi Power from?

Prior to joining Kiwi Power four years ago, I spent a large part of my career in banking – in fact, I was there for 20 years. I was involved in technical activities for the big banks and took a keen interest in big data, regulatory compliance and process. Although a very different sector, it turned out to be very relevant for life at Kiwi Power given technology’s crucial role in energy. So, I brought that skill-set with me, introducing cloud computing and real-time data feeds to our distributed energy resource platform.

How important is real-time visibility to power generation?

It’s essential. If you don’t know what your asset is doing, and subsequently don’t know how much capacity it has, you cannot easily respond to the needs of the market. We place a lot of focus on real-time data, for example we’re currently looking at sub-second pricing, so every milli-second counts. That’s why we engineered our distributed energy platform, Kiwi Core, to give us second-by-second visibility of the assets we manage. It provides the accuracy and reliability to dispatch assets at the exact moment the grid needs the support. And what’s more, it’s simple to use.

How does the platform work?

To get the platform right we need a good database. One that can cope with ingesting huge amounts of data without fail, while also making it readable, digestible, and therefore, actionable. Security is also key and cloud technology plays a crucial role here. We’re cloud hosters, which underpins the fundamentals of the platform in a secure way. It is also important to think about this technology from an end user perspective. Collecting and analysing this data only give clients value if they can access it in an easy-to-understand format. We use web technology to display this information with a real-time stream, so there’s no refreshing or clunky loading of pages.

Is it all about software?

Software and technology are key elements, but we also own a valuable piece of hardware – Kiwi Fruit. This hardware comes into its own with legacy grid assets where we can plug the Fruit in and gain real-time control. We’ve partnered with Electric Imp for their software-as-a-service solution to provide a secure, end-to-end channel for managing the assets.

How does this work support the grid?

The grid has evolved and adapted as demand for renewable energy has grown. This has led to the growth of aggregators who help people to monetise distributed energy resources (DERs) and support the grid. The growth of renewables requires more demand management actions and ultimately helps to reduce the CO 2 intensity of the grid, as we reduce our reliance on fossil fuel generation. Demand side response remains complex, so a lot of people aren’t yet accessing the market. Our platform enables more people to participate. This opens more market entrants and encourages competition, which ultimately reduces power prices.

What impact has Covid-19 had?

The flexibility trend is here to stay so in that sense Covid-19 hasn’t had an impact on the direction of travel. But it did create some short-term impacts for National Grid ESO – in short – the normal grid profile changed. It was harder to predict when peaks would occur, which saw DERs become even more valuable to help balance the grid.

How will this change in the future?

One obvious area is electric vehicles. We could have potentially millions of energy assets through EVs, providing demand management services to the grid. Coal plants are coming offline, so it’s important we expand grid flexibility to support our transition to an even greener energy mix. We’ll reach a point where energy management becomes part of our everyday lives and is no longer seen as disruptive. We’re here to support people on the journey to a more flexible future by simplifying the process for all involved.

A version of this interview first appeared on Renewable Energy Magazine.