The transition to fixed charging- and how Kiwi Core can help you ease the pain

I can imagine the conversations that many Energy Managers will have been having with their bosses since the Targeted Charging Review was published at the backend of 2019. ‘Do you want the bad news, or the bad news?’.

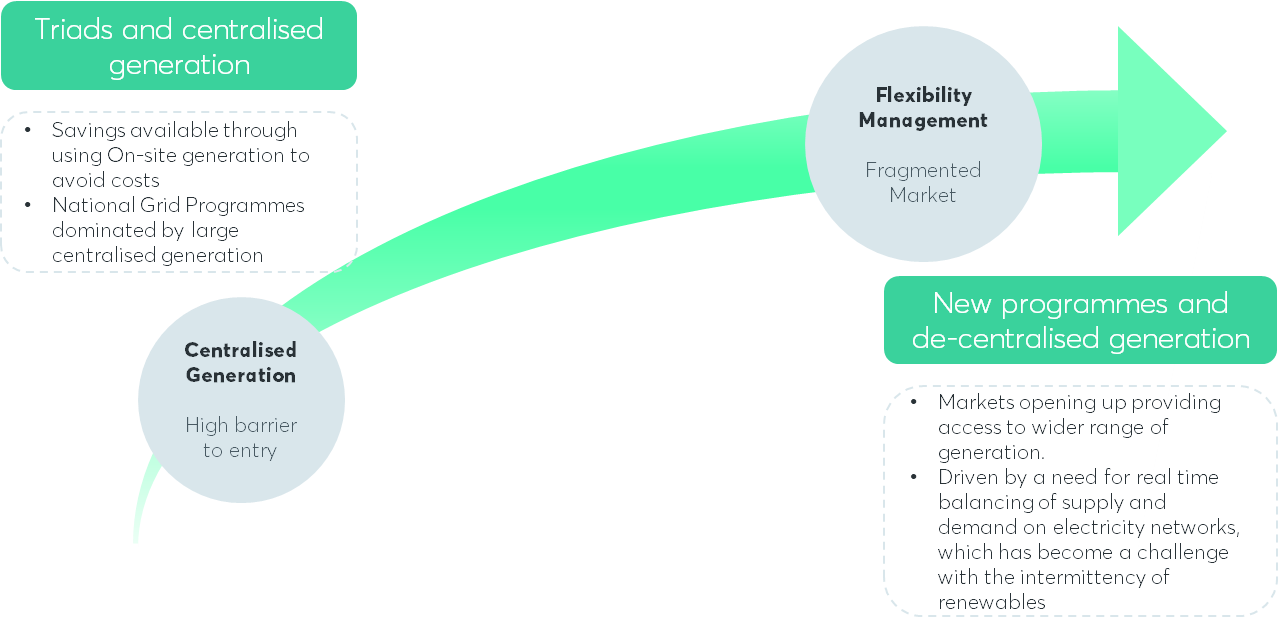

Historically, there has been a big focus for these Energy Managers on cost avoidance – helping some companies save millions of pounds through cleverly managing their operations so that they were running less, or or even zero power during the three Triad1 periods set annually by the National Grid.

But as of April 2022 (after it was delayed a year), this system will change – no longer providing a way for people to avoid charges through behaviours such as load shifting or on-site and embedded generation.

Ofgem’s aim is to create a level playing field between flexible users that are able to reduce consumption during peak periods and those with a lack of flexibility who are currently left paying a higher price. They also propose to remove perceived cross-subsidies from Embedded Benefits to other less flexible customers.

There are many good reasons for doing this – not least because this will create more predictability on the grid as power generation is evened out, helping it to become more stable, efficient and sustainable; at the same time, it’s a very different way of operating which the industry will have to quickly adapt to – and big industrial energy users may rack up millions more in energy bills as a result.

But there is some good news. Whereas it is unlikely to yield the kinds of cash that cost avoidance did, it can go some way to easing the blow.

The asset that you used to avoid a cost is highly likely to be able to be utilised in the flexibility market. By shifting the way we see our onsite energy generation so that it becomes a source of revenue, we can go some way to recouping some of the money that we will have to pay with the new charges by making the most of the Flexible Energy Assets already in our hands.

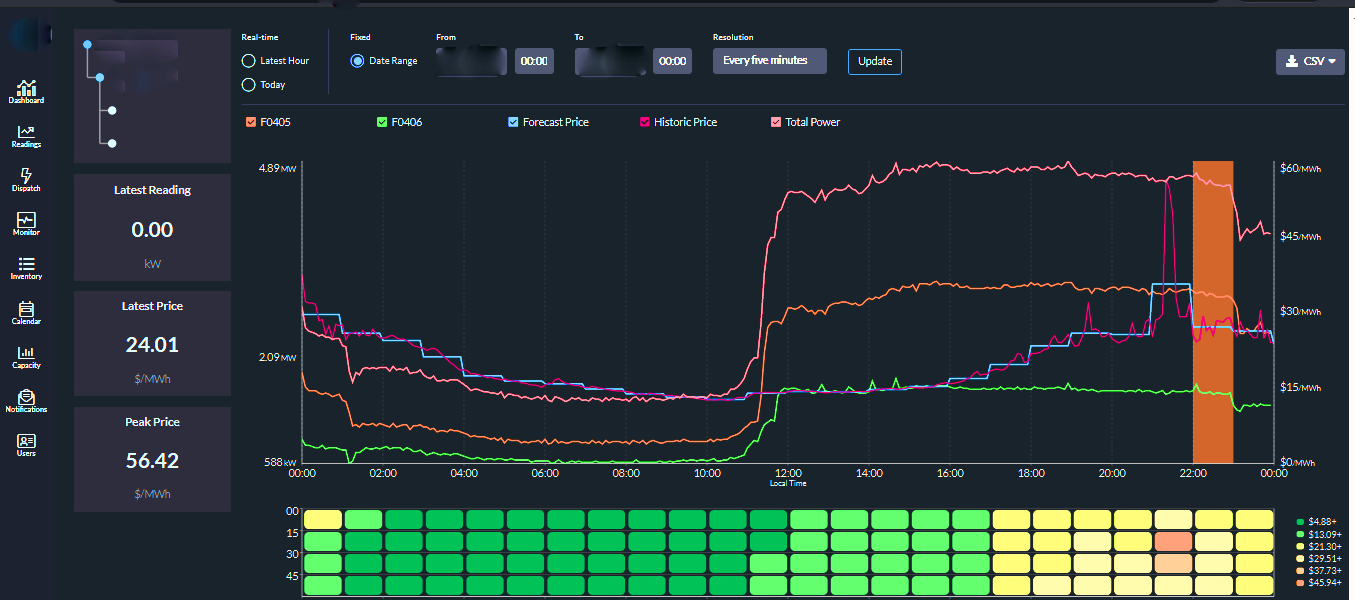

Our energy flexibility platform, Kiwi Core, helps you generate revenue by giving you access to multiple markets in which to sell the energy that you generate – both on a national scale through the various Ancillary Markets or locally through distribution managed constraint markets. It all sounds very complex, but we make it easy to choose the right option by simplifying participation so anyone can do it, whilst ensuring you’re operating at a level of risk that is comfortable for you and making the most revenue possible.

Of course, demand management won’t disappear. You can still save money by turning off your power; and coupled with the reduction in decentralized generation as coal plants are decommissioned, and the increase in intermittent renewable sources, there is an increased need for real-time balancing of supply and demand on energy networks. We can help you support this move to a renewable network by enabling you to sell power to the markets when it is needed, helping to even out that intermittency.

This transition to renewables saw a huge surge forward last year as a result of COVID-19, giving us a valuable glimpse into a net zero future. In a recent webinar we ran, John Twomey – Head of Market Development at National Grid ESO – shared that he saw energy demand suppressed by up to 20%, plus a really high penetration of energy flexibility. Over a particularly sunny bank holiday weekend, we saw some settlement periods of 100% renewables.

In response, the National Grid had to quickly introduce a new ancillary service in the form of an ODFM (Optional Downward Flexibility Management) product. This is targeted at smaller Flexible Energy Assets, of which 4GB were quickly signed up – providing us with a service where we can turn down generation as and when we need it.

As we continue to move towards Net Zero, and increased renewables penetration, many Energy Managers will be asking how they can help support the transition to a more sustainable future and ensure they are making the most of the opportunities out there. They will also be asking how they can afford the money to pay the new charges.

At Kiwi Power we are seeing an increasing interest in Kiwi Core as Energy Managers, and their consultants, look to use our software to access the flexibility markets, generate revenue to replace the value eroded through the loss of Triads and provide the necessary flexibility to enable the grid to transition to renewables. Many are seeing Kiwi Core as an ‘ace up their sleeve’ to pull out during difficult conversations.

We’d love to help you transition into making the most of energy flexibility. We invite you to talk to us about what that might look like for you as we quickly shift into this very different, much more sustainable future with energy flexibility at its core.

1. Triads are half-hour settlement periods that are used to determine charges for demand customers based on how much power they are using at the three highest peaks of electricity annually. They typically occur between 4pm and 6pm on weekdays between November and February each year and must be at least ten days apart.